In an aging bull market such as the one we are experiencing in the United States, finding stocks with a compelling valuation case is hard to do. If one has a contrarian view of the world, it makes sense to look through the "fire sale" bin of the losers of the current bull market to try and find a steal. However, this can also be a recipe for putting good money after bad and getting involved in a value trap. The five biggest losers of this bull market in the MSCI World Index are listed in the table below. Somewhat surprisingly, each stock is in a different GICS sub-industry. The five sub-industries represented are coal and consumable fuel (Peabody Energy), gold (Newmont Mining), personal products (Avon), oil and gas drilling (Diamond Offshore Drilling) and diversified metals and mining (Freeport McMoRan). These stocks are undeniably cheap relative to the average stock in the MSCI USA Index. For example, the average stock in in the MSCI USA Index has a price to cash flow ratio of 16x. For this group of worst performers, price to cash flow ratios range from 8.4x (Avon) to 3.9x (Peabody Energy). So given price to cash flow valuations that are 48% to 76% cheaper than the average stock, is now a good time to be a buyer?

The 5 Worst Performing Stocks Over The Past Four Years In MSCI USA

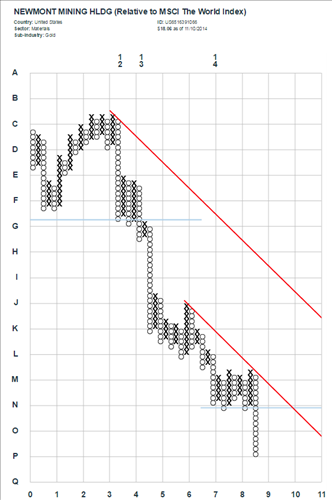

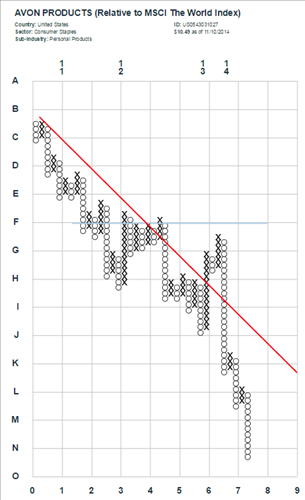

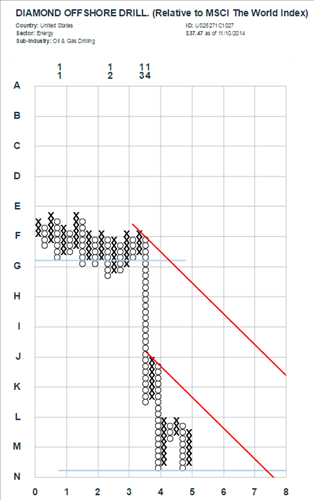

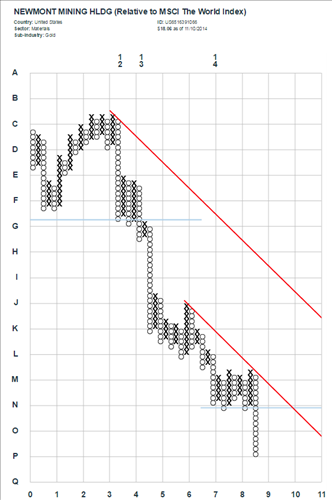

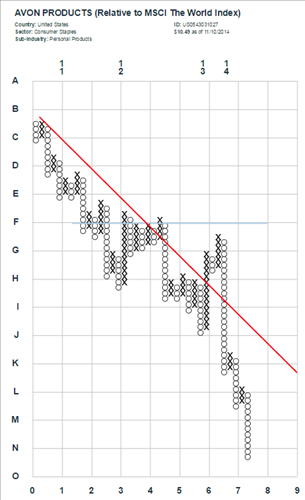

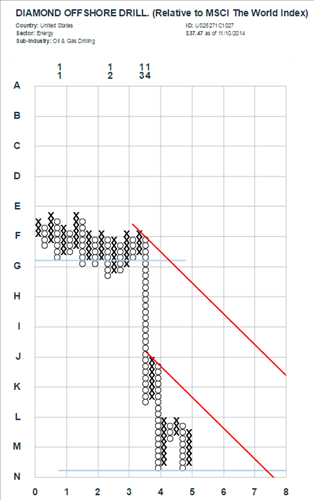

The relative point and figure charts show that these stocks are clearly in a long-term down trend and are not even in the early stages of forming a base. The most constructive thing we can say about any of these charts is that Diamond Offshore Drilling may be forming a fragile base. However, given similar chart formations in Newmont and Freeport McMoRan that eventually gave out to new lower lows, we would be highly skeptical that this "base" can hold. These five stocks all look like value traps.